Welcome!

Thank you for Visiting our

"Correcting The Past"

You have questions?... Our Team Has Answers!

Here at the

CRU Master Solutions Hub!!!

Welcome to the #1 Education Hub for all your Financial Education questions provided to you by:

DECADE Financial Solutions

You are MORE than a Credit SCORE!

Financial Education is far more than just fixing some negative items on a credit report!

Its about understanding how "money" truly functions so that you can leverage it to create the success YOU DESERVE!

We hope you enjoy the information provided on this page and Thank you for letting us be of service!

Financial Solutions for ANY level of Financial Challenge !!

Have a quick question? Contact Live Chat Support!

Be sure to gather all questions you may have pertaining to your credit. Send us a SMS through our live chat located in the bottom right of each page within the DECADE Client Relations Hub.

Understanding The Credit Repair Process

"Correcting The Past"

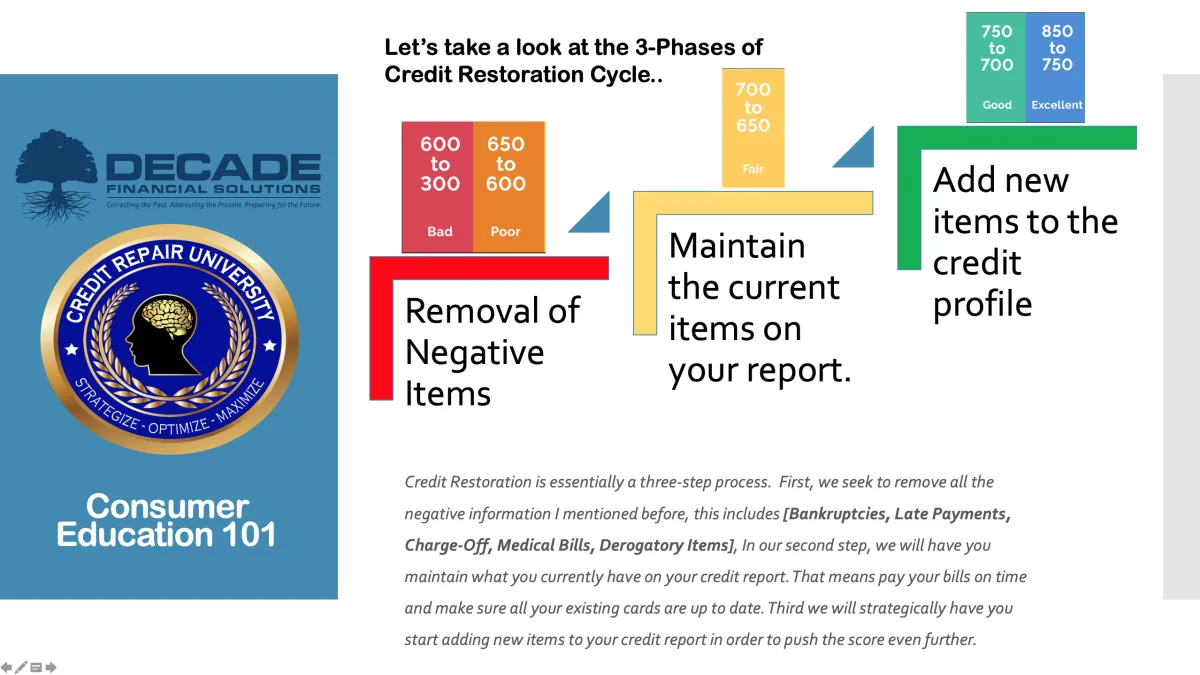

"Correcting the past" of a consumers credit situation is really a 3 Phase Process. Take a look at this slide chart that explain how each phase of the cycle should result in a client's credit score being within a certain range.

"Correcting The Past"

- Removal of Negative Items

Consumer Dispute letters are sent out on a client's behalf to address the issue of "Inaccuracy, Fairness, Verifiability, and Substantialness." That main piece of legislation that is used is The Fair Credit Reporting Act

- Maintaining what's currently on the credit report.

I know it sounds redundant, HOWEVER most consumers fail at paying their bills on time! This type of behavior has huge negative impact on your credit report. Other contributing factors are "Credit Card Usage %," "Types of Credit Accounts (Too many loans or too many credit cards) and AGE of a credit account.

- Adding new credit items to the credit profile

Many new consumers don't recognize the importance of adding credit accounts to their profile in order for their AGE to build over time. This is why we recommend for clients to add at lease TWO CREDIT ACCOUNTS during the time they are participating in their progam.

- Difficulty getting approved for an apartment

Many people don't realize landlords check credit before approving a rental application. Having bad credit can make it much more difficult to rent an apartment or house. You may need to put down a higher deposit, or may get rejected altogether.

- Defeating the Debt of Divorce

If you've recently been through a divorce — or are contemplating one — you may want to look closely at issues involving credit. Understanding the different kinds of credit accounts opened during a marriage may help illuminate the potential benefits —and pitfalls — of each.

- Know your rights with Debt Collection

If you’re behind in paying your bills, or a creditor’s records mistakenly make it appear that you are, a debt collector may be contacting you. Reputable credit counseling organizations employ counselors who are certified and trained in consumer credit, money and debt management, and budgeting. Those organizations that are nonprofit have a legal obligation to provide education and counseling.

Video 1: Understand the Basics

Watch this Video below to learn more about...

Credit Score Basics

Five Key Factors That Make A Credit Score

- Payment History: 35% Key question lenders have on their minds when they give someone money: “Will I get it back?

- Amounts Owed: 30% So you might make all your payments on time, but what if you’re about to reach a breaking point?

- Length of Credit History: 15% Your credit score also takes into account how long you have been using credit.

- New Credit: 10% Your FICO score considers how many new accounts you have.

- Types of Credit in Use: 10% The final thing the FICO formula considers in determining your credit score is whether you have a mix of different types of credit, such as credit cards, store accounts, installment loans, and mortgages

Video 2: How to Fix BAD Credit Score ASAP

Watch this Video below to learn more about...

Credit Score Basics

Video 3: What is Debt?

Watch this Video below to learn more about...

How Debt Works!

Have you checked out your Client Relations Portal Yet?

Need an Appointment with your Solutions Team?

What You’ll Do Before the Call

Be sure to gather all questions you may have pertaining to your credit. You can even have credit reports ready if you wish! The more information we have, the more detailed will your consultation be!

Are you enjoying the service? Please leave us a REVIEW!

DECADE literally gave me a fresh start. Before, I was stressed out and exhausted from being turned down from lender to lender. As of now, I am currently in the final phase of purchasing a new home.

In just one month of doing business with them, my credit went up 40 points and I am sure it's going to rise some more!

DECADE was able to get a huge Judgement deleted. Due to DECADE's response to the collection saving me over $10,100.. I finally qualified for a Mercedes Benz!