Welcome!

Thank you for Visiting our Page!

Addressing The Present

You have questions?... Our Team Has Answers!

Here at the

CRU Master Solutions Hub!!!

Welcome to the #1 Education Hub for all your Financial Education questions provided to you by:

DECADE Financial Solutions

Navigate Back To Your Favorite Page From Our Menu

The More Money works for you... The less you have to work for money!

"Addressing Your Present" circumstances includes developing new money habits that will help breed success in the future!

Its about understanding how "money" truly functions so that you can leverage it to create the success YOU DESERVE!

We hope you enjoy the information provided on this page and Thank you for letting us be of service!

Financial Solutions for ANY level of Financial Challenge !!

- Savings Goals Explained

- What is an Interest Rate?

- Checking (vs) Savings

- Score Tracker

- Score Builder

- Score Master

- Who is the Federal Reserve?

- What is Compound Interest

- Reboot Your Finances

- Child support

- Judgements

- Money Manager Tool

- ID Theft

- Judgement

Money Management Basics 1-0-1

Checking Vs Savings Accounts

The main difference between checking and savings accounts is that checking accounts are primarily for accessing your money for daily use while savings accounts are primarily for saving money. Checking accounts are considered “transactional,” meaning that they allow you to access your money when and where you need it

"Basic Strategies To Effective Money Management"

- Minimize Credit Card Debt

Being able to eliminate debt and build savings will certainly remove some major stressors and unhappiness from your life. Therefore, the most important money habit is to simply reduce credit card debt (here are 33 ideas to help you get started.)

- Tracking Your Expenses

Each evening, record everything that you and your family purchased that day. Make sure to keep all of your receipts, credit card statements, and notes so you are able to look back on each expenditure.

- Make & Review A Monthly Budget

Then, take 30 minutes each week to do a larger budget review where you take the time to look at the big picture of where you’re spending your money, and check to see if you have been sticking to your plan.

- Negotiate your Bills with your Creditors

Because most companies do not want to lose you as a customer to their competitors, they are often likely to work with you to get your monthly bill down to a more reasonable amount!

- Every little bit ... adds up to a lot!

Buying a snack may seem like an inexpensive thing, but spending money on these small things every day really adds up. a simple way to save money is to eliminate those small, recurring purchases that add up to a substantial amount of cash.

- Two Quotes Are Better Than One

Do your research before making a major purchase by comparing prices on different websites. The bigger and more expensive the purchase, the more important it is to spend time researching your options. Not only will this save you money, it will also help you make a better-educated decision when it comes to purchasing the item.

Money Management Basics 1-0-1

How Can you REBOOT your Finances?

Rebooting your finances can be a real challenge! However, here is a simple plan that you can put into motion to help yourself GET STARTED!

"Basic Strategies To REBOOT Your Finances"

- Re-Budget

This is common advice for a reason -- it's nearly impossible to manage your money effectively if you have no idea where it's going. You need to figure out what you're currently spending on, decide what changes you want to make, and give each dollar you earn a purpose.

- Re-Evaluate Expenses

One of the big reasons for making a written budget is to identify areas where you're overspending. If you can reduce outflow on nonessentials, you'll have more money left over to do important things such as paying off debt and saving for your future.

- Replenish The Emergency Fund

Emergencies are inevitable, so set aside a good amount of cash to cover them. Ideally, you should have THREE to NINE months of living expenses saved up in an emergency fund so you're prepared for big disasters such as a job loss or serious health issue.

- Re-Program Your Debt Payoff Plan

If your creditors are currently charging you high interest rates, or if you owe lots of different creditors, consider refinancing debt using a low-interest personal loan or transferring the balance of your cards to a 0% APR balance transfer card. Lowering your rate and consolidating your debt makes paying it off much easier.

- Re-Visit Extra Income Opportunities

You can only cut spending so much, but there's no limit to the extra money you can earn. Asking for a raise, taking on a side hustle or joining the gig economy can boost your earnings substantially. This extra money can be used for debt repayment, savings, or giving you enough cash to cover the essentials.

- Re-Automate Your Financial Life

Once you have a budget with a set amount of money allocated for savings and debt repayment, set up automatic bill pay and automatic transfers to your savings and investment accounts. Set up these transfers to happen the day you get paid, then limit yourself to only spending what's left over.

Money Management Basics 1-0-1

How to Manage Credit Cards?

"Here are some Smart Credit Card Habits"

- 30% Usage is a LIE!

That's RIGHT! You read that right! Keeping your Credit Card balance at 30% is a Guaranteed way to LOWER your credit score. Instead, try managing the limits less than TEN PERCENT!

- How to Calculate Credit Usage Ratio?

The credit utilization ratio is how much of the available credit you’ve used compared to your total credit limit.

For example, if you have a $1,000 balance on an account with a $5,000 limit, your credit utilization ratio for that card equals $1,000/$5,000, or 20 percent.

- "Debt Stacking" or "Debt Snowball"

Not all debts are created equal. There are several options for prioritizing your debt. Consider which option works best for you and your financial situation:

- Pay off the card with the lowest balance first

- Pay off the card with the highest interest rate

- Focus on the card with the highest utilization ratio

- Pay MORE than the Minimum

However you plan to pay off your debt, it’s smart to pay more than your minimum to every creditor each month. Your card issuers view a minimum payment as a sign of financial stress.

- DON'T Close unused credit cards!

It’s typically best to keep your credit cards open so that you have a lower utilization ratio. Individual accounts have their own credit utilization ratios but the average utilization ratio of all your accounts is important. Having an available credit limit that you aren’t using will decrease your utilization ratio and help improve your credit.

- Use Rewards to Improve Financial Health

If you have a pure cash back credit card, use any cash rewards you receive to put toward your account balance or direct deposit it into a savings account. Alternatively, if you have a rewards points credit card, you can use your rewards to buy discounted gift cards to the stores you know and love—saving on future purchases without having to use your credit card. accounts. Set up these transfers to happen the day you get paid, then limit yourself to only spending what's left over.

"The Ultimate Credit & Money Management Tool"

Score Tracker, Score Builder, Score Master!

Score Tracker

Become the Master "tracker" of all things credit with this nifty tool. See all your different types of credit

scores and see how they're progressing. See how your scores change over time to get a better understanding.

Score Builder

ScoreBuilder™ creates a personalized 120-day plan to help you understand what is hurting and helping your credit score, plus what actions you can take.View your negative accounts weighing down your score and take action to take care of them.

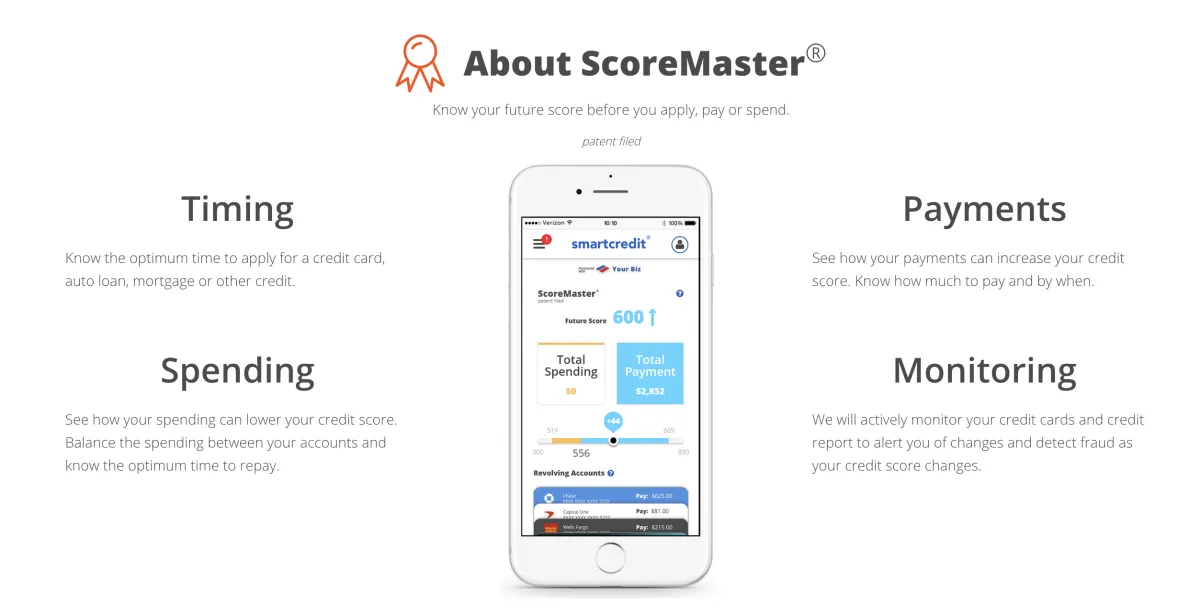

Score Master

ScoreMaster® has your money, credit and identity in one place with Action buttons and score tools. See how your payments can increase your credit score. Know how much to pay and by when. Know the optimal time to apply for a credit card, auto loan, mortgage or other credit.

You will finally be able to:

- How to know THE EXACT steps to eliminate ALL the negative marks on your credit report within 150 days or less!

- It is now easier than ever to "Track" all your scores with simple charts or in-depth information.

- See exactly what is helping or hurting your credit score. "Build" your 120-Day Plan to a better score.

- Be the "Master" of your credit score! Use ScoreMaster® before you apply for credit, make payments or spend money.

Be sure to gather all questions you may have pertaining to your credit. You can even have credit reports ready if you wish! The more information we have, the more detailed will your consultation be!

Money Management Basics 1-0-1

Who is Federal Reserve?

The Federal Reserve System (FRS), often called simply "the Fed," is the central bank of the United States and arguably the most powerful financial institution in the world. It was founded to provide the country with a safe, flexible, and stable monetary and financial system

"The Things You Need To Know About The Fed"

- What is the Federal Reserve's Job?

The Fed’s first job, the one that Americans are most familiar with, is raising or lowering interest rates. These are the rates that determine how much it costs to borrow money, to buy a car or a home mortgage or almost anything else you might want to borrow money for.

- Why should I care to know this information?

The Fed affects you by influencing the interest rates you pay. But more importantly now, it is making sure that EVERYONE has all the money anyone will ever need. Credit flows, companies stay afloat, paychecks arrive, people spend, and the economy goes on. That's why the Fed matters.

- Why & What is "Inflation?"

Sometimes, if the Fed lowers interest rates too much, more people are going to borrow. People who borrow are going to spend. The things that they buy, there’s going to be more demand, prices are going to go up. And what do you know, there’s inflation.

- What in the world is "Monetary Policy?"

In 1977, Congress issued what is known as the “dual mandate” to guide Fed decision-making, which states that the two primary goals of monetary policy should be to achieve maximum employment and stable prices within the economy:

- Employment & Price Stability

In order to meet the dual goals of maximum employment and price stability, the Fed takes a broad spectrum approach, weighing a wide range of economic trends and indicators-like employment data, inflation rates, consumer confidence, business investment, health of the housing sector and much more-to get a fuller sense of the health and direction of the economy.

- Uncle "Fed' has been around a LONG time

When Congress wrote the Federal Reserve Act in 1913, one objective of the Fed was to help banks acquire emergency cash reserves to meet such panic withdrawals, so that the shortage of funds at one bank didn't disrupt the entire banking system.

"Interest" Takes On Many Forms

What You’ll Do Before the Call

Be sure to gather all questions you may have pertaining to your credit. You can even have credit reports ready if you wish! The more information we have, the more detailed will your consultation be!

Are you enjoying the service? Please leave us a REVIEW!

DECADE literally gave me a fresh start. Before, I was stressed out and exhausted from being turned down from lender to lender. As of now, I am currently in the final phase of purchasing a new home.

In just one month of doing business with them, my credit went up 40 points and I am sure it's going to rise some more!

DECADE was able to get a huge Judgement deleted. Due to DECADE's response to the collection saving me over $10,100.. I finally qualified for a Mercedes Benz!